Move cash exactly where it’s needed at any given time, automatically and securely.

The combination of advanced cash forecasts, intraday transfers, and automatic cash pooling puts you in total control of your account balances. Even the most complex organizations can stay on top of cut-offs and automate transfers with ease—no coding required.

Accurate forecasts allow you to proactively transfer cash to accounts before they go into overdraft, and to minimize bank fees across the board. Create custom rules and settings that comply with your internal policies and corporate strategies. Rest easy knowing your accounts won’t dip below zero, and you’ll always be ready to jump on a financial opportunity at a moment’s notice.

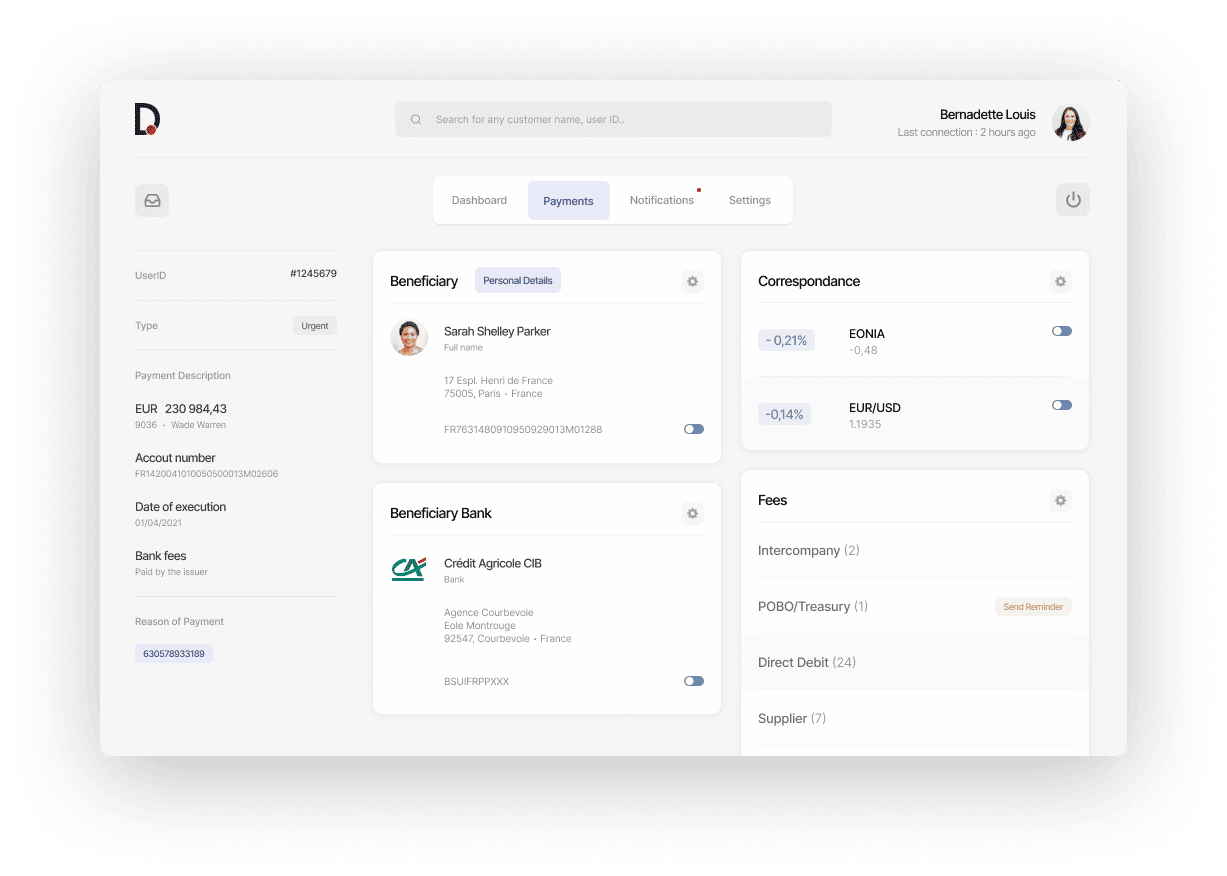

Avoid unnecessary bank fees, prevent overdrafts, and automate intra-group netting. Datalog TMS automatically matches actuals with forecasts and moves surpluses into accounts with a negative balance, or into accounts with better terms or interest rates.

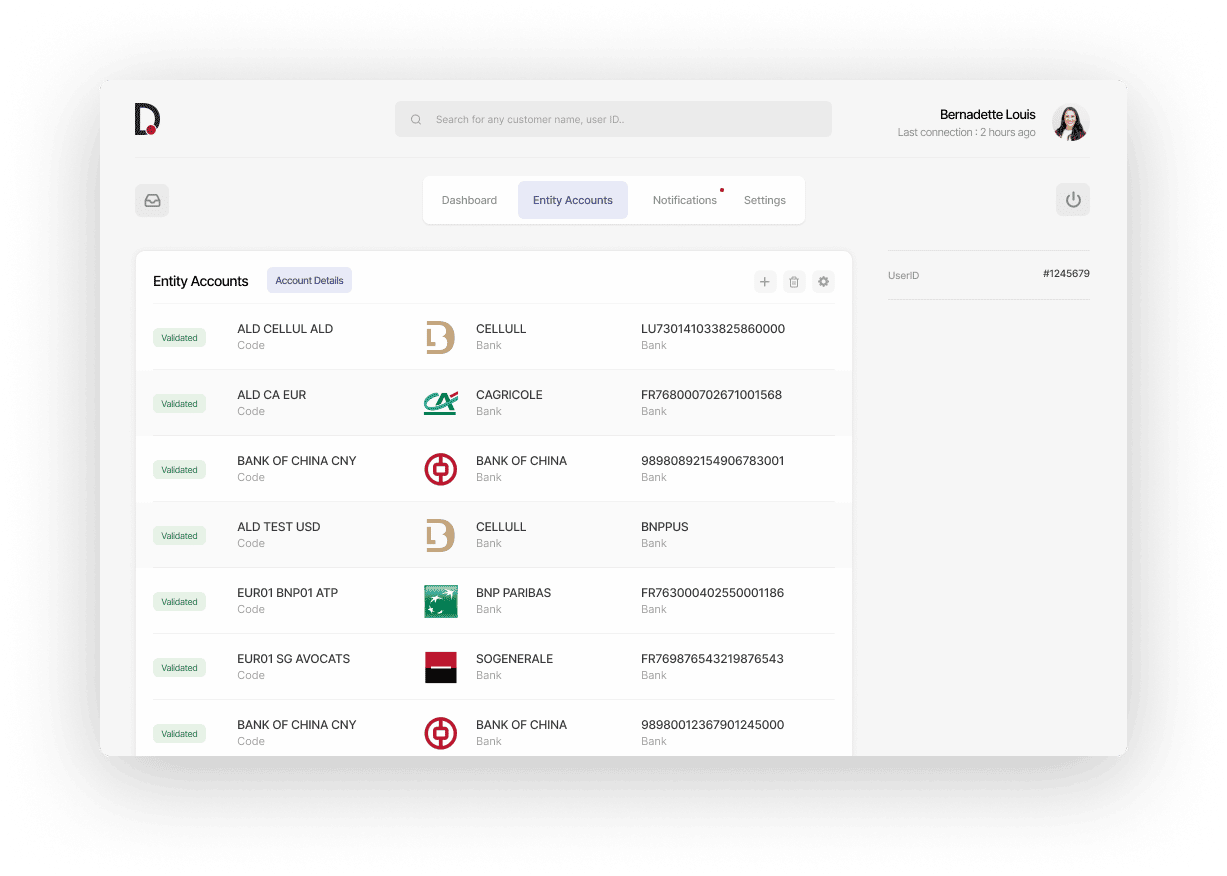

Dynamically generate balances and pull up oustanding accounts. Create multi-criteria and multi-dimensional liquidity reports. Import/export data from any ERP or legacy system in any format. Datalog TMS automatically scans bank statements, recognizes entries, identifies recurring patterns, and builds accurate cash forecasts at the account level. Quickly analyze the group’s cash position and that of each subsidiary.

Advanced AI algorithms combine forecasts with historical trends, ERP data, and external factors (weather, current events, and more) to generate smart, entity-level projections about how your liquidity may fluctuate in the short, medium, and long term. Precise cash forecasting allows you to take on less debt and save on interest.

Should you place excess cash in a short-term interest-bearing account? Or would the cash be better used to settle a debt with a low-interest intercompany loan, rather than a higher-interest bank loan? Answer questions like these on the fly with Datalog’s Cash & Liquidity Management module and use surplus cash more productively.

Generate different financing scenarios automatically, compare the advantages and disadvantages of internal financing versus bank loans, lower costs, and find the best interest rates.

Support your cash management strategy with the best investment and financing options. Set up automatic cash pooling. Distribute cash by bank or by revenue flow. Datalog TMS supports all banking protocols.

Simplified, automated cash movement ensures that you always meet your financial obligations. Thanks to intraday cash and liquidity management functionality, you have the tools you need to meet the dynamic cash demands of the business at any time of day.

Navigate interest rates for all accounts, including the retroactive values of subsequent entries. Manage any bank fee category: unit expenses, commission rates, and fees based on various levels or tranches. Schedule transfers to take place on optimal dates.

Cash & Liquidity Management works well with Payment Factory, Risk Management, and all other Datalog TMS modules, as well as any internal IT system. Adapt settings, rules and workflows to accommodate your internal processes—all without IT intervention.

Emmanuel Arabian, VP Financing and Treasury, SEB Groupe

Sylvie Faure, Forecasting Expert, Renault

Samer Sibahi, Head of Project Management and Treasury Systems

Contact us for a demo today and experience the Datalog difference.

Find out more about who we are, where we’ve come from, and where we’re headed.

Find out how our solutions can help you manage and optimize your company’s liquidity, cash flow, banking communications, and other financial activities effectively and efficiently.

Payment Factory

Automate, track & control all of your inbound & outbound payments from one centralized system.

Cash & Liquidity Management

Automate a continuous flow of cash to the right places across your global business accounts.

In-House Banking

Configure and manage intra-group transfers, loans, and financial compensation from a central SaaS platform.